10 Business Tax Planning Strategies to Maximize Your Savings

29 February 2024

The Ultimate Business Succession Planning Checklist

20 March 2024As a business owner or financial manager, you know how important it is to accurately understand your company's finances.

The month-end close gives you that detailed view by reconciling accounts, recording transactions, and generating financial statements.

Following a structured month-end close process lets you gain insights into your business's financial health and make data-driven decisions.

In this post, we will walk through the steps of the month-end close, provide a downloadable checklist, discuss the benefits of using a checklist, and share best practices for month-end close success.

What is the Month-End Close Process?

The month-end close, also called close of books, refers to the procedures and tasks required to update a company's financial records at the end of each month.

Some key goals include:

- Recording all revenue and expenses for the month

- Reconciling account balances

- Updating inventory records

- Generating financial statements

- Reviewing data and metrics to identify trends

Properly closing the books allows you to gain financial insights, fulfill tax and accounting requirements, and start the next month error-free. It includes recurring administrative tasks that ensure transactions are categorized and reported correctly.

Why Is The Month-End Close Process Important?

Because you need well-measured and managed financial data for each month at the end of the financial year, the month-end close process becomes vital. The month-end close process calculates the month’s expenses, received amounts, interests, etc. properly.

Here are the Top 5 reasons why the month-end process is important:

1. Finance Records

A month-end close process tracks all your financial records accurately. Because of making each month's up-to-date financial reports, your annual closing process becomes more straightforward for the financial year.

2. Cash Allocations

The month-end close process gives a cash review of the business. You can allocate cash to each department for the expenses, payments, and costs

3. Tax Returns & Audits

Because of updated monthly financial reports, you get help with your tax returns and annual auditing.

4. Stakeholders Interests

The outside stakeholders of the company get info about the company’s financial health from each month-end closing. The month-end close process takes care of the outside interests such as investors, lenders, tax agencies, etc.

5. Improvement & Strategy

The month-end close process acknowledges required improvement and guides a thorough strategy for the next month.

What Are The Benefits of Using A Month-End Close Checklist?

Here are the top 4 benefits of using a month-end close checklist:

1. Accurate Account Records

You can keep accurate account records by using a month-end close checklist. The checklist helps to track accounts receivable and payable correctly.

2. Effective Cash Management

The month-end close checklist helps effectively in cash management. The checklist clarifies cash deposits, the cash balance in the bank account, and the overall cash flow of the month.

3. Simplified Taxes & Payments

The month-end close checklist simplifies taxation and other payments such as compensation, rent, expenses, interests, etc.

4. Clarifies Asset Value

The month-end close checklist clarifies business asset value and measures inventory in the business.

What Information Does Accounting Need for Month-End Close?

Here is the information your accounting needs for month-end close:

1. Total revenue

2. Bank accounts data

3. Inventory level (if applicable)

4. Total fixed assets

5. Total Petty cash

6. Balance sheets

7. Income and expense accounts

8. Financial statements

9. General ledger

How Is a Month-End Close Performed?

- Firstly, the accounting team reviews and verifies all the account data to ensure that all the accounting information is accurate.

- Here, the regular journals help to reduce errors and avoid delays when it is time for the month-end close.

- All departments finalize their side financial data and provide the utmost support to the accounting team by following Generally Accepted Accounting Principles (GAAP) to ensure organizational coordination.

- With this information, the accounting team can perform the month-end close. Primarily, the accounting team first reconciles subsidiary ledgers to the general ledgers in the process.

- Journal entries of monthly transactions such as depreciation, loan interest, and expenses must be performed at the time of month-end close.

- Then the team will enter invoice amounts in the accounting system as accounts payable and will enter customer or client invoice amounts in the system as per account payable or receivable.

- After this, they will track the revenue, and liabilities and reconcile other reports, bills, and deposits of the month and enter that amount into the accounting system.

- Now they will generate month-end financial statements such as profit-loss statements, cash flow statements, balance sheets, and other reports as per business industry.

- After completing the statements, review all the accounts and cross-verify the entered amounts. If any calculation error arises, then they will rectify it.

- Finally, you can officially close the month and distribute financial statements among the business departments.

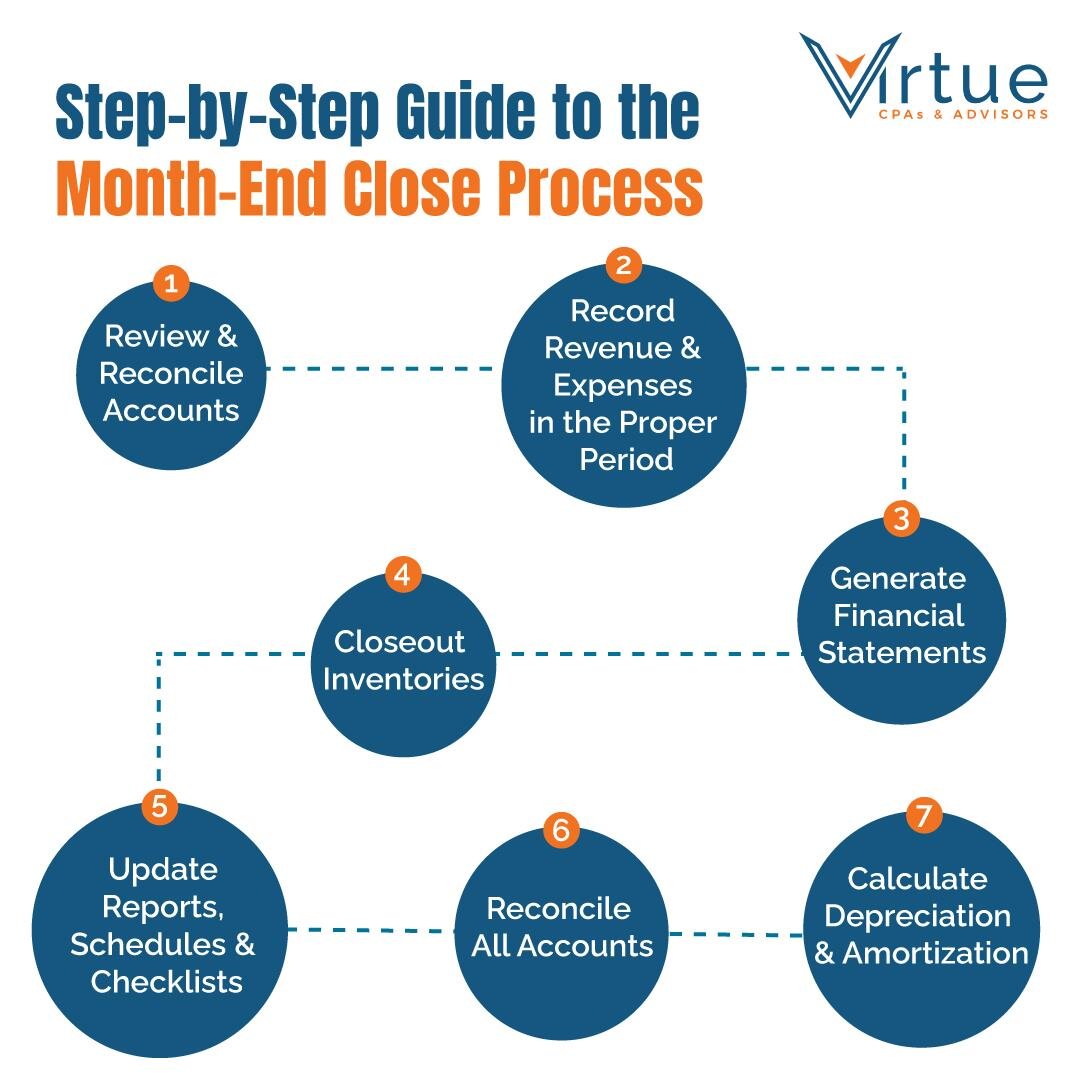

Step-by-Step Month-End Close Process

Closing your books involves several key steps, performed in a specific order to ensure the accuracy of your financial statements.

Here are the major activities needed for a complete month-end close:

1. Review and Reconcile Accounts

The first step is reviewing and reconciling all balance sheet accounts, including:

- Bank accounts

- Accounts receivable

- Accounts payable

- Credit cards

- Fixed assets

- Accrued liabilities

You’ll want to match GL account balances to supporting sub-ledgers, statements, or schedules.

So, research and resolve any discrepancies you uncover between systems. Also, verify that accounts are properly valued and record any necessary adjustments or accruals.

Look for incorrectly recorded transactions, unrecorded assets/liabilities, or any misalignments between your books and supporting records. Your reconciliations ensure every transaction is posted to the right account.

2. Record Revenue and Expenses in the Proper Period

Next, record all revenue and expenses in the correct accounting period. This step is crucial for accurate financial statements.

Review pending invoices or unearned revenue at month end — record earned revenue or defer unearned amounts. Most importantly, accrue any unpaid expenses so they reflect in the proper period.

After that, scrutinize aged receivables and payables reports to catch pending transactions near the cutoff date.

Ideally, you should want a clean break between months.

3. Generate Financial Statements

Now it’s time to draft your preliminary financial statements. Run a trial balance and review financials for accuracy and completeness.

Do your statements align with expectations?Investigate any account variances or discrepancies.

Then, record any necessary adjustments and post to an adjusted trial balance.

Once all accounts are reconciled and final transactions posted, you can finalize your month-end financial statements. These will form the basis for reporting and analysis.

4. Close Out Inventories

If your business holds inventory, you’ll need to perform a thorough count and valuation at month's end. Your general ledger must match the actual inventory levels found through counting.

Record any adjustments needed including lost inventory, obsolescence, changes in valuation method, etc.

Accurate inventory accounting has a big impact on your cost of goods sold and profitability.

5. Calculate Depreciation and Amortization

For your fixed assets, calculate and post depreciation or amortization for the current period.

Keep an eye out for any obsolete, damaged, or fully depreciated assets needing retirement.

Additionally, you also need to review your asset listing, schedules, and registers while recording monthly depreciation. Based on this, update your records for any changes in estimated useful life or asset valuations.

6. Reconcile All Accounts

With your books now fully updated, perform final reconciliations to verify accuracy.

Reconcile bank statements, credit cards, payables, and receivables. Research any lingering discrepancies.

Old outstanding checks or unresolved differences can distort your GL, so follow up on any reconciliation issues.

In the end, your books should match external records.

7. Update Reports, Schedules, and Checklists

Finally, it’s time to update any internal close processes and checklists to improve next month’s close.

Prepare supporting reports and documentation files for the completed period close. Update your financial analysis tools, forecasts, and budgets.

Reviewing this close will highlight areas for future process improvement.

With this, your books are now closed cleanly!

5 Common Month-End Close Mistakes - And How To Avoid Them

1. Data Errors

Duplicate data, double data entry, mistakes in amount, etc. are the most common mistakes in the month-end close process. These small data errors can cause big problems in accounts.

Therefore, when the accounting team enters data manually, you have to ensure that all entries are cross-checked in the accounting system. You need high coordination in the accounting team to avoid data errors.

2. Insufficient Team

There are no sufficient team members in the accounting team in several organizations, which is one of the reasons why month-end close takes a longer time than usual. Businesses need to acknowledge the requirement of sufficient accountants so that the month-end close process can be done on time.

3. Late in Financial Statements

The lack of collaboration in the team, mismanagement of data, and delays in the quick flow of data from departments to the accounts department are some mistakes that make financial statements late.

If the accounting team takes time to prepare financial reports, then you need to improve timely data circulation, coordination in the team, and guidance on time.

4. Lack of Automation

Manual data entry in spreadsheets and other manual processes makes the process lengthy. After the manual process, revisions and corrections take their time. Thus month-end can not close on time.

Here, you need to identify the team member who can make the process automated with various accounting software programs and tools.

5. Undefined System

Not having a standard process to follow in month-end close, makes the accounting team clueless. You have to set up a defined system for working on the month-end close process.

Your accounting team with a standard process works to deliver error-free results and close the month-end in a defined timeline.

Month-End Close Checklist

Here is a comprehensive month-end close checklist to keep you on track:

- Reconcile and review all balance sheet accounts

- Record all pending transactions and adjustments

- Accrue expenses and defer revenues to the proper period

- Take inventory counts and value inventory

- Calculate and record depreciation/amortization

- Reconcile bank, receivables, and payable accounts

- Generate and review financial statements

- Record any necessary journal entries

- Update reports, budgets, forecasts, and schedules

- Close accounting books for the month

Month-End Close Best Practices

Streamlining and improving your month-end close process lets you complete the close faster and more accurately.

Here are some proven best practices:

Prepare Early and Set a Closing Schedule

One of the most important best practices is to start closing preparations early – don’t wait until the last minute!

Begin getting organized at least 5 business days before your scheduled close date. Gather everything you’ll need, including account reconciliations, invoices, bills, payroll records, journal entries, reports, and any other information.

Create a detailed closing schedule and checklist, assigning tasks and deadlines to staff. Set calendar invites for key meetings and coordinate with other departments so everyone understands their roles and responsibilities.

By planning ahead, you can methodically work through the close process versus rushing into a frenzy at the end. This reduces stress, mistakes, and inefficiencies for your team.

Follow the Close Checklist

Develop a consistent closing checklist for your finance team to follow each period. This ensures all important steps are completed on time and accurately.

The checklist should include key tasks like

- Reconciling accounts

- Recording recurring journal entries

- Running reports

- Reviewing pending transactions

- Communicating deadlines

- Verifying sub-ledger to general ledger account balances

- Entering final adjustments

- Closing accounting periods

- Archiving documents

…and more.

The checklist will keep everyone organized, promote accountability, and minimize errors caused by lapses or oversight.

Automate Where Possible

Manual processes are inefficient. So take time to identify activities that can and should be automated in your close process. This saves time and improves accuracy for your team.

For example, you can consider automating tasks like importing data, reconciling accounts, running reports, sending reminders, recording recurring entries, performing calculations, distributing files, backing up systems, and more.

Reducing the number of manual tasks your staff must complete helps to focus their time on value-adding analysis, problem-solving, and process improvements versus repetitive clerical work.

Review and Improve

After each close, evaluate what worked well and what needs improvement. Identify any issues or bottleneck areas causing delays.

While you’re at it, make sure to get feedback from involved departments and staff. Welcome ideas to enhance processes and address pain points.

Implement procedural changes and system enhancements for the next close based on the feedback.

By continuously reviewing and refining your close, you’ll achieve incremental gains month-over-month. Small changes compound over quarters and years.

Communication and Training

Throughout the close and afterward, communicate deadlines, responsibilities, and priorities with your finance staff clearly and consistently.

Most importantly, train your staff, have team meetings to coordinate efforts, answer questions, and set goals.

Remember, having an organized, streamlined close process is invaluable. It improves timeliness and accuracy while reducing costs and frustration for your finance team.

Adopting these best practices requires some upfront commitment yet pays ongoing dividends. Your accounting staff and business stakeholders will thank you for a faster, error-free close.

Why does month-end close take time?

Because it’s a matter of one month’s whole finance. One month has 8.33% part in your annual closing. When a well-set business starts calculating one month’s finance, the value of 8.33% part rises because of financial proceedings throughout the month.

At the end of the month, every business must perform the financial close to calculate the entire accounts of one month. It takes Five to ten days as the average duration for the accounts team to do the month-end close. You may ask why one week time in calculating just one-month accounts.

However, it’s okay to take time to calculate your finances. Taking the needed time and simplifying every expense, payment, receivable-payable amounts, credit, and revenue, helps you to keep your month-end close error-free.

Top 5 advantages of using a financial close solution

1. Zero Day Close

Your record-to-report process enables zero-day close, providing automated workflows and tentative templates. Zero-day close reduces time duration and last-moment manual tasks.

The whole process has not been delayed and makes the ready-picture of finance. Because of zero-day close, The finance team gets time for other essential financial tasks such as budgeting, forecasting, analysis, etc.

2. Improves Accuracy

Financial close switches from disconnected, manual spreadsheets to cloud-based, updated, safe spreadsheet-style connection developed for finance.

This way the accuracy of finance close improves which eventually increases the transparency in the organization's finances. The financial health of the company stabilizes with improved decision-making.

Financial close reduces the risk of delayed tasks and task errors. The on-time reporting of financial statements increases trust among investors and stakeholders.

3. Real-Time Access

Using Artificial Intelligence makes it easier for the company to get real-time access to financial insights. The team can easily communicate, collaborate, and work together on targets as per current financial status.

The organization can track the performance and identify the gridlock, which helps to make more efficient decisions.

4. Increases Efficiency

The advanced technology of Artificial intelligence (AI) increases efficiency in the month-end close process, which helps the finance team to work on crucial tasks within the deadline.

The efficient and on-time monthly finance close process improves consistency and reduces errors, delays, and stress for the team. Gradually, it leads to the team playing spirit and helps to increase employee satisfaction and retention.

5. Well-Organized Collaboration

Different departments of the company can collaborate on the tasks with every information of the company finances. Thus, The financial decisions are made as per the performance of the current month, and it defines the company goals for the upcoming month.

Well-organized collaboration among finance team members disables errors of double-entry data and accelerates efficiency in financial reporting.

How can Virtue CPAs help in your month-end closing process with automation?

One of the most challenging tasks in your month-end closing process is time. Usually, the month-end closing process takes 5-10 business days to be completed.

Most organizations find it a hectic, lengthy, data-filled process. Often, the lack of technical support, manual data entry, spreadsheet errors, etc. makes it difficult for organizations to complete the month-end close on time.

Virtue CPAs & Advisors is here for your help with fully autonomous support. We are committed to automation in accounting services.

Our Team works to provide you the complete data insights from your accounts transparently and to make the closing process smoother, faster, and free of error.

Conclusion

Closing your books with accuracy and timeliness is critical for financial reporting.

A streamlined month-end close checklist and process will make your business more efficient.

Use this guide to implement consistent workflows, disciplined reconciliation procedures, and continuous improvement to master your monthly close.

That said if you’re completely new to this, you can always reach out to certified and professional CPAs at Virtue CPAs.

We are experienced accounting professionals who can handle your monthly close process for you. Our team follows strict procedures and checks all the boxes needed for an audit-ready close.

We know how challenging month-end can be, so let us handle the heavy lifting while you focus on running your business. With customized bookkeeping and controller services, we become your outsourced accounting department.

Contact us today to learn more about our close process and how we can make month-end a breeze for your company!