As a business owner or financial manager, you know how important it is to accurately understand your company's finances.

The month-end close gives you that detailed view by reconciling accounts, recording transactions, and generating financial statements.

Following a structured month-end close process lets you gain insights into your business's financial health and make data-driven decisions.

In this post, we will walk through the steps of the month-end close, provide a downloadable checklist, discuss the benefits of using a checklist, and share best practices for month-end close success.

What is the Month-End Close Process?

The month-end close, also called close of books, refers to the procedures and tasks required to update a company's financial records at the end of each month.

Some key goals include:

- Recording all revenue and expenses for the month

- Reconciling account balances

- Updating inventory records

- Generating financial statements

- Reviewing data and metrics to identify trends

Properly closing the books allows you to gain financial insights, fulfill tax and accounting requirements, and start the next month error-free. It includes recurring administrative tasks that ensure transactions are categorized and reported correctly.

Simplify Your Month-End Close — Schedule a Free CFO Consultation Today

Why Is The Month-End Close Process Important?

Because you need well-measured and managed financial data for each month at the end of the financial year, the month-end close process becomes vital. The month-end close process calculates the month’s expenses, received amounts, interests, etc. properly.

Here are the Top 5 reasons why the month-end process is important:

1. Finance Records

A month-end close process tracks all your financial records accurately. Because of making each month's up-to-date financial reports, your annual closing process becomes more straightforward for the financial year.

2. Cash Allocations

The month-end close process gives a cash review of the business. You can allocate cash to each department for the expenses, payments, and costs

3. Tax Returns & Audits

Because of updated monthly financial reports, you get help with your tax returns and annual auditing.

4. Stakeholders Interests

The outside stakeholders of the company get info about the company’s financial health from each month-end closing. The month-end close process takes care of the outside interests such as investors, lenders, tax agencies, etc.

5. Improvement & Strategy

The month-end close process acknowledges required improvement and guides a thorough strategy for the next month.

What Are The Benefits of Using A Month-End Close Checklist?

Here are the top 4 benefits of using a month-end close checklist:

1. Accurate Account Records

You can keep accurate account records by using a month-end close checklist. The checklist helps to track accounts receivable and payable correctly.

2. Effective Cash Management

The month-end close checklist helps effectively in cash management. The checklist clarifies cash deposits, the cash balance in the bank account, and the overall cash flow of the month.

3. Simplified Taxes & Payments

The month-end close checklist simplifies taxation and other payments such as compensation, rent, expenses, interests, etc.

4. Clarifies Asset Value

The month-end close checklist clarifies business asset value and measures inventory in the business.

What Information Does Accounting Need for Month-End Close?

Here is the information your accounting needs for month-end close:

1. Financial Data Requirements:

1. Total revenue - All sales transactions and income sources

2. Bank accounts data - All account statements and transaction records

3. Inventory level (if applicable) - Physical counts and valuation data

4. Total fixed assets - Equipment, property, and depreciation schedules

5. Total Petty cash - Physical cash counts and receipt documentation

6. Balance sheets - Previous month's closing balances

7. Income and expense accounts - All GL account activity

8. Financial statements - Prior period comparisons

9. General ledger - Complete transaction history

2. Supporting Documentation:

- Vendor invoices and bills

- Customer payment records

- Bank statements and deposit slips

- Payroll registers and tax filings

- Loan statements and interest calculations

- Insurance policy documents

- Lease agreements and rental payments

- Investment account statements

3. Reconciliation Materials:

- Previous month's reconciliations

- Outstanding check registers

- Aged accounts receivable/payable reports

- Inventory count sheets

- Fixed asset registers

How Is a Month-End Close Performed?

The month-end close follows a systematic approach that ensures accuracy and completeness:

Preparation Phase:

- Data Verification: The accounting team reviews and verifies all account data to ensure accuracy

- Journal Entry Preparation: Regular journals help reduce errors and avoid delays during close

- Department Coordination: All departments finalize their financial data and support the accounting team

- GAAP Compliance: Follow Generally Accepted Accounting Principles (GAAP) for organizational coordination

Execution Phase:

- Subsidiary Reconciliation: Reconcile subsidiary ledgers to general ledgers first

- Monthly Transactions: Record journal entries for depreciation, loan interest, and expenses

- Accounts Payable Processing: Enter vendor invoice amounts into the accounting system

- Accounts Receivable Processing: Enter customer invoice amounts as receivables

- Revenue Tracking: Track revenue, liabilities, and reconcile reports, bills, and deposits

Completion Phase:

- Financial Statement Generation: Create profit-loss statements, cash flow statements, balance sheets

- Account Review: Cross-verify all entered amounts and calculations

- Error Correction: Rectify any calculation errors discovered during review

- Month Closure: Officially close the month and distribute financial statements

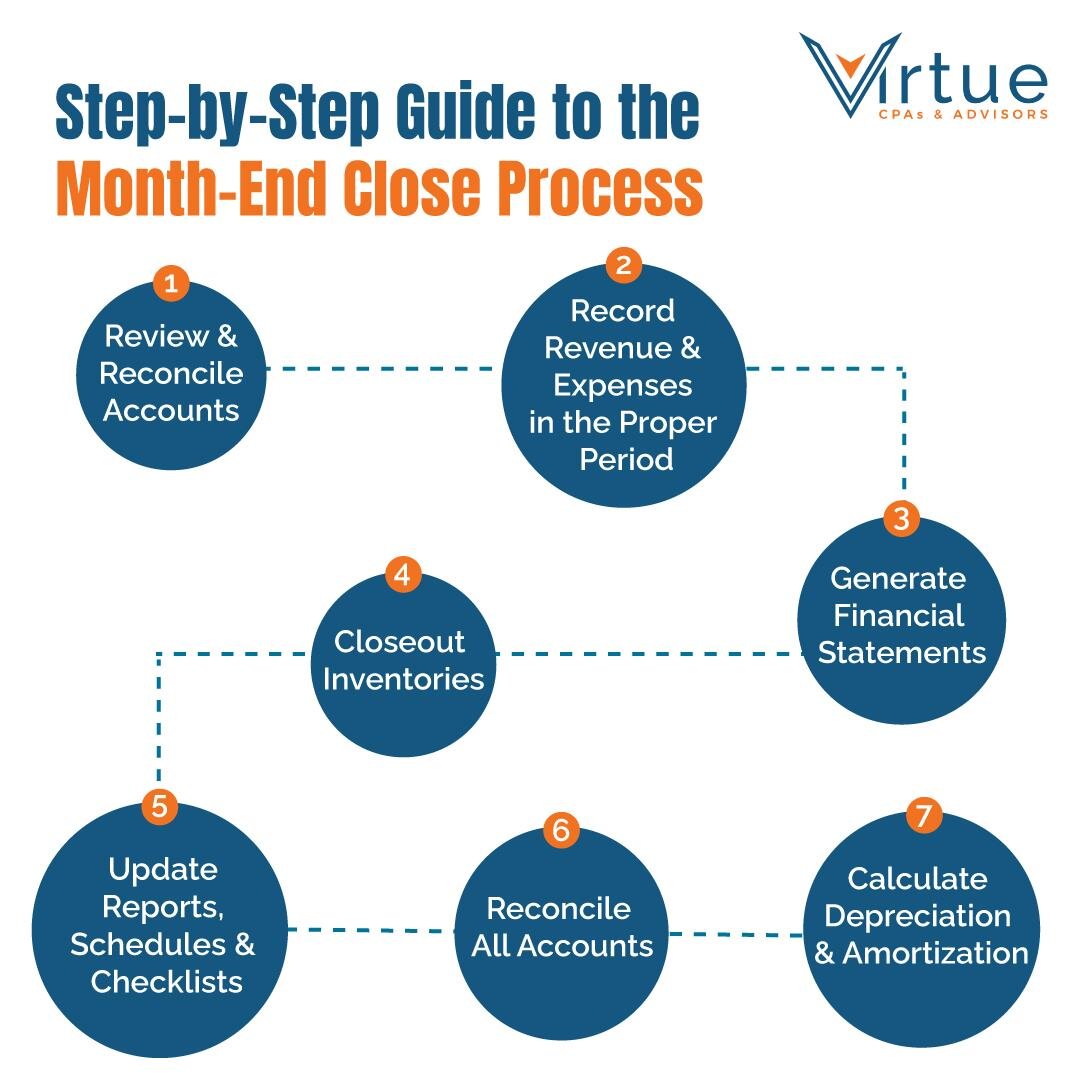

Step-by-Step Month-End Close Process

Closing your books involves several key steps, performed in a specific order to ensure the accuracy of your financial statements.

Here are the major activities needed for a complete month-end close:

Step 1: Review and Reconcile Accounts

The first step is reviewing and reconciling all balance sheet accounts, including:

Primary Account Reconciliations:

- Bank accounts - Match GL balances to bank statements

- Accounts receivable - Verify customer balances and aging

- Accounts payable - Confirm vendor balances and payment status

- Credit cards - Reconcile all corporate card transactions

- Fixed assets - Update depreciation and verify additions/disposals

- Accrued liabilities - Review and update all accrued expenses

Reconciliation Process:

- Match GL account balances to supporting sub-ledgers, statements, or schedules

- Research and resolve any discrepancies between systems

- Verify accounts are properly valued and record necessary adjustments

- Look for incorrectly recorded transactions, unrecorded assets/liabilities

- Address any misalignments between books and supporting records

- Ensure every transaction is posted to the correct account

Step 2: Record Revenue and Expenses in the Proper Period

Next, record all revenue and expenses in the correct accounting period:

Revenue Recognition Tasks:

- Review pending invoices at month end

- Record earned revenue for completed services/deliveries

- Defer unearned revenue to appropriate future periods

- Scrutinize aged receivables reports near cutoff date

- Ensure clean break between accounting periods

Expense Accrual Tasks:

- Accrue unpaid expenses for services received

- Record utility bills and recurring expenses

- Process employee expense reports

- Capture vendor invoices received after month-end for services rendered

- Review contracts for recurring monthly charges

Step 3: Generate Financial Statements

Now it's time to draft your preliminary financial statements:

Statement Preparation:

- Run trial balance to verify account totals

- Review financials for accuracy and completeness

- Investigate account variances or unexpected changes

- Record necessary adjustments and post to adjusted trial balance

- Ensure statements align with expectations and prior periods

Quality Review Process:

- Compare current month to prior month and budget

- Analyze significant variances and unusual transactions

- Verify mathematical accuracy of all calculations

- Ensure proper classification of income and expense items

Step 4: Close Out Inventories

If your business holds inventory, perform comprehensive inventory management:

Physical Inventory Tasks:

- Conduct thorough physical count at month's end

- Verify general ledger matches actual inventory levels

- Record adjustments for lost, damaged, or obsolete inventory

- Update inventory valuation methods if applicable

- Document any significant variances and investigate causes

Inventory Valuation:

- Apply appropriate costing method (FIFO, LIFO, Average)

- Calculate lower of cost or market adjustments

- Review for slow-moving or obsolete items

- Ensure accurate cost of goods sold calculation

Step 5: Calculate Depreciation and Amortization

For fixed assets, maintain accurate depreciation records:

Monthly Depreciation Tasks:

- Calculate and post depreciation for all fixed assets

- Review asset schedules and registers for accuracy

- Identify obsolete, damaged, or fully depreciated assets

- Record asset retirements or disposals

- Update estimated useful life or asset valuations as needed

Asset Management:

- Verify new asset additions are properly capitalized

- Ensure repairs vs. improvements are correctly classified

- Review lease classifications and amortization schedules

Step 6: Reconcile All Accounts

Perform final reconciliations to verify complete accuracy:

Final Reconciliation Checklist:

- Bank statements - Ensure all transactions are recorded

- Credit cards - Verify all charges and payments

- Accounts payable - Confirm vendor statement accuracy

- Accounts receivable - Validate customer account balances

- Investigate and resolve any lingering discrepancies

- Follow up on old outstanding checks or unresolved differences

Step 7: Update Reports, Schedules, and Checklists

Complete the close process with documentation updates:

Process Improvement Tasks:

- Update internal close processes and checklists

- Prepare supporting reports and documentation files

- Update financial analysis tools, forecasts, and budgets

- Review close performance and identify improvement areas

- Archive completed period documentation

With this comprehensive approach, your books are now closed cleanly and accurately!

Struggling with Month-End Clarity? Let Us Help You Fix It

Month-End Close Timeline: Day-by-Day Guide

Efficient month-end close requires proper timing and sequencing. Here's a detailed day-by-day timeline to optimize your close process:

1. Pre-Close Phase (Days -5 to -1)

Day -5: Initial Preparation

- Send cutoff date notifications to all departments

- Prepare recurring journal entry templates

- Review previous month's close issues and resolutions

- Schedule team meetings and assign responsibilities

- Gather necessary supporting documentation

Day -3: Advanced Preparation

- Begin preliminary bank reconciliations

- Update fixed asset registers

- Review aged receivables for collection issues

- Prepare standard monthly accruals

- Coordinate with departments on pending transactions

Day -1: Final Preparation

- Complete transaction cutoff procedures

- Finalize all recurring journal entries

- Prepare inventory count materials

- Review cash projections and bank activity

- Set up close monitoring dashboard

2. Close Execution Phase (Days 1-5)

Day 1: Transaction Cutoff & Initial Processing

- Implement hard cutoff - no backdated transactions

- Process all transactions through month-end

- Begin cash and bank reconciliations

- Start accounts receivable aging review

- Record standard monthly journal entries

Day 2: Primary Reconciliations

- Complete all bank account reconciliations

- Finalize accounts payable reconciliations

- Conduct inventory counts and reconciliation

- Process depreciation and amortization entries

- Review and post month-end accruals

Day 3: Financial Statement Preparation

- Generate preliminary financial statements

- Perform variance analysis against budget/prior period

- Complete all balance sheet reconciliations

- Review income statement for accuracy

- Investigate significant variances

Day 4: Review and Adjustments

- Conduct management review of financial statements

- Process any necessary adjusting entries

- Complete final reconciliations

- Prepare supporting schedules and reports

- Verify mathematical accuracy of all statements

Day 5: Finalization and Distribution

- Finalize all financial statements

- Complete month-end close checklist

- Archive supporting documentation

- Distribute reports to stakeholders

- Close accounting periods in system

3. Industry Benchmarks:

- Fast Close: 1-3 business days (with automation)

- Standard Close: 5-7 business days (typical)

- Extended Close: 8-10+ business days (needs improvement)

Industry-Specific Month-End Close Considerations

Different industries face unique challenges during month-end close. Here's specialized guidance for various sectors:

1. Manufacturing Companies

Inventory-Focused Considerations:

- Work-in-Progress (WIP) Valuation: Calculate accurate WIP based on production stages

- Raw Materials: Track material usage and waste calculations

- Finished Goods: Coordinate with production to ensure accurate counts

- Standard Cost Variances: Analyze material, labor, and overhead variances

- Production Reporting: Reconcile production reports with inventory movements

Special Challenges:

- Multi-location inventory coordination

- Complex bill of materials tracking

- Production cycle timing issues

- Scrap and rework accounting

2. Service-Based Businesses

Revenue Recognition Focus:

- Project Percentage Completion: Calculate accurate project completion percentages

- Unbilled Receivables: Accrue for services performed but not yet invoiced

- Deferred Revenue: Properly defer advance payments for future services

- Time Tracking: Ensure all billable hours are captured and recorded

- Contract Modifications: Account for change orders and scope adjustments

Key Considerations:

- Professional services billing accuracy

- Retainer and advance payment handling

- Multiple project management

- Resource utilization tracking

3. Retail Businesses

Complex Inventory Management:

- Multi-Location Inventory: Coordinate counts across all retail locations

- Shrinkage Calculations: Account for theft, damage, and counting errors

- Seasonal Adjustments: Handle seasonal inventory valuation changes

- Gift Card Liabilities: Track outstanding gift card balances

- Promotional Allowances: Account for vendor rebates and markdown allowances

Retail-Specific Challenges:

- Sales transaction volume management

- Returns and exchange processing

- Vendor allowance tracking

- Seasonal inventory fluctuations

4. SaaS and Technology Companies

Subscription Revenue Management:

- Monthly Recurring Revenue (MRR): Calculate accurate MRR figures

- Annual Contract Value (ACV): Track annual contract performance

- Revenue Recognition (ASC 606): Comply with software revenue recognition rules

- Customer Acquisition Costs: Track and amortize customer acquisition expenses

- Churn Analysis: Calculate customer churn and retention metrics

Technology-Specific Considerations:

- Multi-element revenue arrangements

- Software development cost capitalization

- Research and development expense tracking

- Intellectual property valuation

5. Healthcare Organizations

Regulatory Compliance Focus:

- Patient Revenue Cycles: Manage complex insurance billing and collections

- Regulatory Reporting: Ensure compliance with healthcare regulations

- Bad Debt Provisions: Calculate appropriate allowances for uncollectible accounts

- Insurance Reconciliations: Reconcile complex insurance payment structures

- Charity Care: Account for charity care and community benefit programs

6. Construction Companies

Project-Based Accounting:

- Percentage of Completion: Calculate accurate project completion percentages

- Change Orders: Account for approved and pending change orders

- Retention Receivables: Track customer retentions and release schedules

- Job Cost Allocation: Ensure accurate job cost tracking and allocation

- Subcontractor Reconciliation: Reconcile all subcontractor billings and payments

Month-End Close Checklist

Here is a comprehensive month-end close checklist to keep you on track:

- Reconcile and review all balance sheet accounts

- Record all pending transactions and adjustments

- Accrue expenses and defer revenues to the proper period

- Take inventory counts and value inventory

- Calculate and record depreciation/amortization

- Reconcile bank, receivables, and payable accounts

- Generate and review financial statements

- Record any necessary journal entries

- Update reports, budgets, forecasts, and schedules

- Close accounting books for the month

Month-End Close Best Practices

Streamlining and improving your month-end close process lets you complete the close faster and more accurately.

Here are some proven best practices:

1. Preparation and Planning Best Practices

Prepare Early and Set a Closing Schedule One of the most important best practices is to start closing preparations early – don't wait until the last minute!

Advanced Planning Strategies:

- 5-Day Head Start: Begin getting organized at least 5 business days before scheduled close

- Resource Gathering: Collect account reconciliations, invoices, bills, payroll records, journal entries

- Detailed Scheduling: Create comprehensive closing schedule with task assignments and deadlines

- Team Coordination: Set calendar invites for key meetings and coordinate with other departments

- Role Clarity: Ensure everyone understands their specific responsibilities and deliverables

Timeline Optimization Techniques:

- Continuous Close Approach: Complete tasks throughout the month, not just at month-end

- Parallel Processing: Run multiple reconciliation processes simultaneously

- Dependency Mapping: Identify task dependencies to optimize workflow sequence

- Resource Loading: Balance workload across team members to prevent bottlenecks

- Contingency Planning: Prepare backup plans for common issues and delays

2. Process Standardization and Consistency

Follow the Month-End Close Checklist Develop a consistent closing checklist for your finance team to follow each period:

Checklist Excellence Standards:

- Task Prioritization: Organize tasks by priority and dependency requirements

- Time Estimates: Include realistic time estimates for each major task

- Quality Checkpoints: Build in review and approval steps at critical junctures

- Documentation Requirements: Specify exactly what documentation is needed

- Escalation Procedures: Define when and how to escalate issues or delays

Advanced Checklist Features:

- Real-time Status Tracking: Use project management tools for live progress updates

- Automated Reminders: Set up system-generated alerts for approaching deadlines

- Historical Comparison: Track performance metrics month-over-month

- Exception Reporting: Highlight variances and unusual items requiring attention

- Continuous Improvement: Regular checklist updates based on lessons learned

3. Technology and Automation Optimization

Automate Where Possible Manual processes are inefficient and error prone. Identify automation opportunities:

High-Impact Automation Areas:

- Bank Reconciliation: Automated matching of transactions and statements

- Journal Entry Processing: Standard monthly entries with automated posting

- Report Generation: Automated financial statement and analysis report creation

- Data Integration: Seamless data flow between systems and applications

- Notification Systems: Automated alerts for deadlines, exceptions, and approvals

Advanced Automation Strategies:

- Robotic Process Automation (RPA): Automate repetitive, rule-based tasks

- Machine Learning Integration: Use AI for anomaly detection and variance analysis

- Workflow Automation: Create automated approval workflows for journal entries

- Data Validation: Automated checks for data completeness and accuracy

- Exception Management: Automated flagging of items requiring manual review

Technology Stack Optimization:

- ERP Integration: Ensure seamless integration between all financial systems

- Cloud-Based Solutions: Leverage cloud technology for accessibility and collaboration

- Mobile Capabilities: Enable mobile access for approvals and reviews

- Real-Time Dashboards: Implement live performance monitoring dashboards

- Backup and Recovery: Maintain robust data backup and disaster recovery procedures

4. Team Management and Communication

Communication and Training Throughout the close and afterward, maintain clear communication:

Communication Excellence:

- Daily Stand-ups: Brief daily meetings to review progress and address issues

- Clear Deadlines: Communicate specific deadlines with buffer time built in

- Priority Alignment: Ensure team understands priorities and can make trade-off decisions

- Issue Escalation: Establish clear escalation paths for problems and delays

- Success Metrics: Share performance metrics and celebrate improvements

Advanced Training Programs:

- Cross-Training: Train team members on multiple close processes for flexibility

- Technology Training: Regular training on new software and automation tools

- Best Practice Sharing: Regular sessions to share tips and process improvements

- Industry Updates: Training on new accounting standards and regulatory changes

- Stress Management: Training on managing deadline pressure and maintaining accuracy

5. Continuous Improvement and Quality Assurance

Review and Improve After each close, evaluate performance and identify improvement opportunities:

Performance Analysis:

- Timing Analysis: Track actual vs. planned completion times for each task

- Error Tracking: Document and analyze errors to prevent recurrence

- Bottleneck Identification: Identify and address process constraints

- Resource Utilization: Analyze team member workload and capacity

- Stakeholder Feedback: Gather input from report users and other departments

Advanced Quality Assurance:

- Independent Reviews: Implement independent verification of critical calculations

- Analytical Reviews: Use data analytics to identify unusual transactions or trends

- Control Testing: Regular testing of internal controls and processes

- Audit Readiness: Maintain documentation standards that support external audits

- Risk Assessment: Regular evaluation of close process risks and mitigation strategies

Innovation and Modernization:

- Emerging Technology: Stay current with new accounting technology and tools

- Industry Benchmarking: Compare performance against industry best practices

- Process Reengineering: Periodic fundamental review and redesign of close processes

- Vendor Evaluation: Regular assessment of software vendors and service providers

- Future Planning: Strategic planning for close process evolution and scaling

By implementing these comprehensive best practices, you'll achieve a faster, more accurate, and less stressful month-end close process.

5 Common Month-End Close Mistakes - And How To Avoid Them

1. Data Errors

Duplicate data, double data entry, mistakes in amount, etc. are the most common mistakes in the month-end close process. These small data errors can cause big problems in accounts.

Industry-Specific Examples:

- Manufacturing: Duplicate inventory transactions between locations

- Retail: Double entry of sales transactions from multiple POS systems

- SaaS: Incorrect subscription revenue recognition amounts

- Healthcare: Patient billing errors and insurance claim duplications

Prevention Strategies:

- Ensure all entries are cross-checked in the accounting system

- Implement automated data validation rules and controls

- Use system-generated sequential numbering for all transactions

- Require high coordination and communication in the accounting team

- Establish independent review processes for high-risk transactions

2. Insufficient Team

There are no sufficient team members in the accounting team in several organizations, which is one of the reasons why month-end close takes a longer time than usual.

Resource Optimization Solutions:

- Acknowledge the requirement of sufficient accountants for timely completion

- Cross-train team members to handle multiple responsibilities

- Implement temporary staffing solutions during peak close periods

- Prioritize automation to reduce manual labor requirements

- Consider outsourcing certain close activities to qualified professionals

3. Late in Financial Statements

There are no sufficient team members in the accounting team in several organizations, which is one of the reasons why month-end close takes a longer time than usual.

Collaboration Improvement Strategies:

- Improve timely data circulation between departments

- Enhance coordination and communication within the team

- Provide guidance and training on deadline management

- Implement real-time data sharing systems

- Establish clear accountability for timely deliverables

4. Lack of Automation

Manual data entry in spreadsheets and other manual processes makes the process lengthy. After the manual process, revisions and corrections take up their time.

Automation Implementation:

- Identify team members who can implement process automation

- Invest in accounting software programs and tools

- Automate recurring journal entries and calculations

- Use electronic document management systems

- Implement automated approval workflows

5. Undefined System

Not having a standard process to follow in month-end close makes the accounting team clueless.

System Standardization:

- Set up a defined, documented system for month-end close procedures

- Create standard operating procedures (SOPs) for all close activities

- Implement consistent workflows and approval processes

- Establish clear roles and responsibilities for each team member

- Regularly update and improve standardized processes based on feedback

Close Confidently Each Month — Start With Trusted Virtual CFO Guidance

Why does month-end close take time?

Because it’s a matter of one month’s whole finance. One month has 8.33% part in your annual closing. When a well-set business starts calculating one month’s finance, the value of 8.33% part rises because of financial proceedings throughout the month.

At the end of the month, every business must perform the financial close to calculate the entire accounts of one month. It takes Five to ten days as the average duration for the accounts team to do the month-end close. You may ask why one week time in calculating just one-month accounts.

However, it’s okay to take time to calculate your finances. Taking the needed time and simplifying every expense, payment, receivable-payable amounts, credit, and revenue, helps you to keep your month-end close error-free.

Top 5 advantages of using a financial close solution

1. Zero Day Close

Your record-to-report process enables zero-day close, providing automated workflows and tentative templates. Zero-day close reduces time duration and last-moment manual tasks.

The whole process has not been delayed and makes the ready-picture of finance. Because of zero-day close, The finance team gets time for other essential financial tasks such as budgeting, forecasting, analysis, etc.

2. Improves Accuracy

Financial close switches from disconnected, manual spreadsheets to cloud-based, updated, safe spreadsheet-style connection developed for finance.

This way the accuracy of finance close improves which eventually increases the transparency in the organization's finances. The financial health of the company stabilizes with improved decision-making.

Financial close reduces the risk of delayed tasks and task errors. The on-time reporting of financial statements increases trust among investors and stakeholders.

3. Real-Time Access

Using Artificial Intelligence makes it easier for the company to get real-time access to financial insights. The team can easily communicate, collaborate, and work together on targets as per current financial status.

The organization can track the performance and identify the gridlock, which helps to make more efficient decisions.

4. Increases Efficiency

The advanced technology of Artificial intelligence (AI) increases efficiency in the month-end close process, which helps the finance team to work on crucial tasks within the deadline.

The efficient and on-time monthly finance close process improves consistency and reduces errors, delays, and stress for the team. Gradually, it leads to the team playing spirit and helps to increase employee satisfaction and retention.

5. Well-Organized Collaboration

Different departments of the company can collaborate on the tasks with every information of the company finances. Thus, The financial decisions are made as per the performance of the current month, and it defines the company goals for the upcoming month.

Well-organized collaboration among finance team members disables errors of double-entry data and accelerates efficiency in financial reporting.

How can Virtue CPAs help in your month-end closing process with automation?

One of the most challenging tasks in your month-end closing process is time. Usually, the month-end closing process takes 5-10 business days to be completed.

Most organizations find it a hectic, lengthy, data-filled process. Often, the lack of technical support, manual data entry, spreadsheet errors, etc. makes it difficult for organizations to complete the month-end close on time.

Virtue CPAs & Advisors is here for your help with fully autonomous support. We are committed to automation in accounting services.

Our Team works to provide you the complete data insights from your accounts transparently and to make the closing process smoother, faster, and free of error.

Conclusion

Closing your books with accuracy and timeliness is critical for financial reporting.

A streamlined month-end close checklist and process will make your business more efficient.

Use this guide to implement consistent workflows, disciplined reconciliation procedures, and continuous improvement to master your monthly close.

That said if you’re completely new to this, you can always reach out to certified and professional CPAs at Virtue CPAs.

We are experienced accounting professionals who can handle your monthly close process for you. Our team follows strict procedures and checks all the boxes needed for an audit-ready close.

We know how challenging month-end can be, so let us handle the heavy lifting while you focus on running your business. With customized bookkeeping and controller services, we become your outsourced accounting department.

Contact us today to learn more about our close process and how we can make month-end a breeze for your company!

Month-End Close FAQs: