Introduction

IRS every year provides instructions for Schedule SE for self-employed taxpayers. Learning from Schedule SE instructions 2024, we discuss here how to file your self-employment tax and what Schedule SE instructions are. This blog is a complete guide to filing your self-employment tax.

What is Schedule SE?

The IRS schedule SE calculates how much self-employment tax individuals owe. It is part of Structure 1040, which is used to file your tax return. The schedule SE helps determine your total self-employment tax, which is reported on another part of Structure 1040 – Schedule 2 (Section II, line 4).

Self-employment tax includes both Social Security and Medicare taxes, like the deductions taken from your paycheck when you work for someone else. Self-employed taxpayers need to pay both self-employment and income taxes.

Who is required to file Schedule SE?

If you made $400 or more this year, you need to submit a self-employment income tax return to the IRS using Schedule SE. However, if you're a church employee and earned at least $108.28, you also need to file.

What does self-employment income mean?

You generate self-employment income when you work for yourself. If you have a business as a sole proprietor, an independent contractor, a partner, or in any other capacity (including running a part-time business), the IRS considers you to be self-employed.

If you're not sure what any of those terms mean, go to the IRS's Self-Employed Individuals Tax Center for more information.

Where can I get my self-employment income?

Calculate your total self-employment income before filling out Schedule SE. Your income will be determined in one of four locations on your tax return.

Schedule C (line 31)

Use Schedule C to calculate your total self-employment income if you had sole proprietorship or were self-employed. All your freelance income goes on line 31.

Schedule K-1 (line 14a)

If you're a partner in a partnership, you'll need to report your share of the partnership's income or loss on line 14a of Schedule K-1 of Form 1065. Usually, this payment is subject to self-employment tax.

Schedule F (line 34)

On line 34 of Schedule F of Form 1040, you report the total income (or loss) from farming.

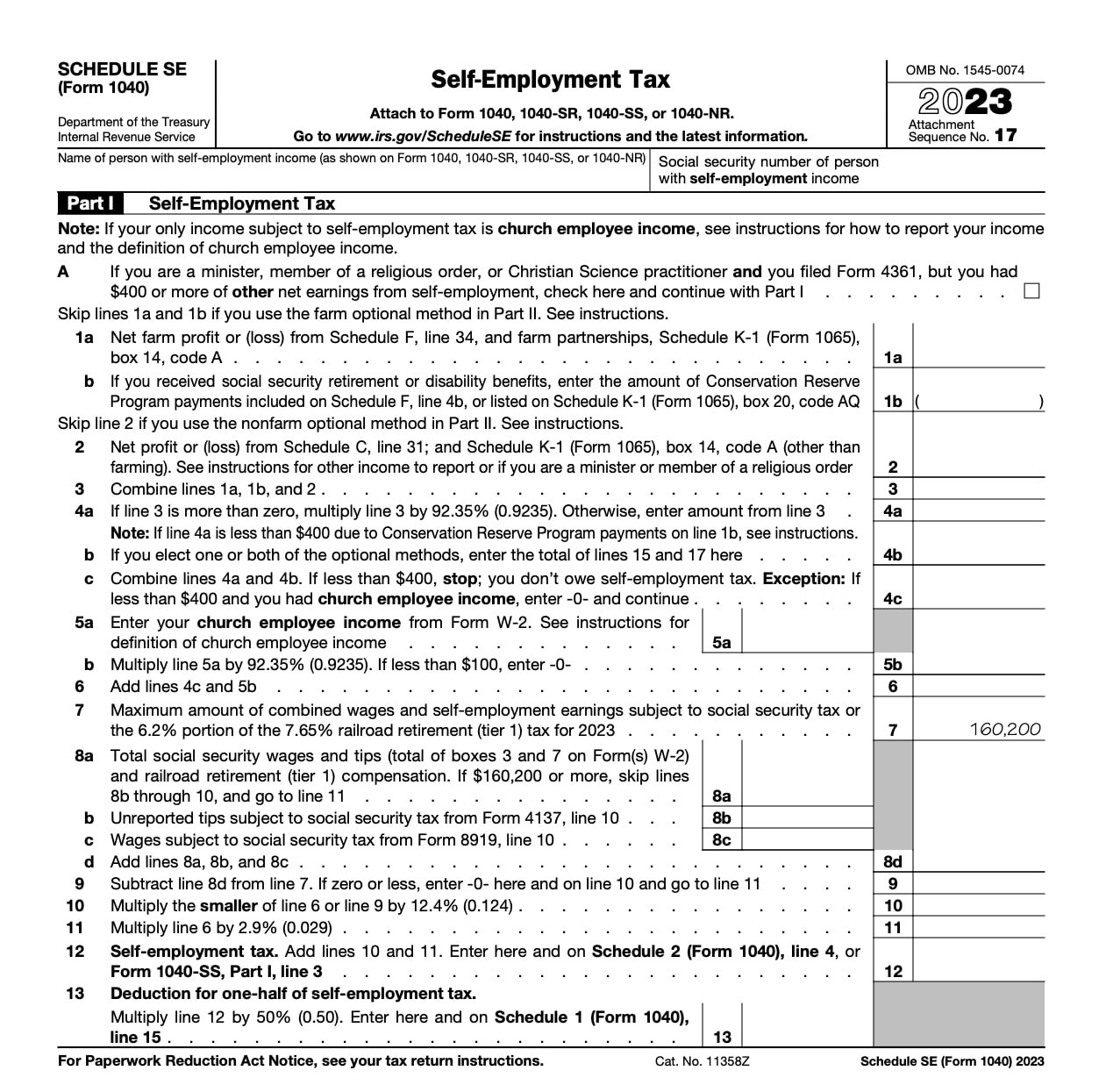

How does Schedule SE appear?

Schedule SE is a form with two parts from the IRS, the first page of which seems to be this:

How to fill out Schedule SE Form?

In the past, Schedule SE had a long and short form, but now it has two sections. Most self-employed individuals only need to fill out Part I. Part II includes two optional methods that require meeting certain criteria.

Part I - Self-employment tax

- If you're not a farmer, you don't have to be concerned about lines 1a and b, as they pertain specifically to income from farming.

- Calculate your net profit by multiplying your total self-employment income by 92.35%. Then, enter the resulting amount from line 4c into line 6 (unless you also received income as a church employee and received a Form W-2).

- The most you can subtract from Social Security taxes is $142,800, as stated on Line 7. The calculations on Lines 9 to 10 will utilize this information.

- Record any profit from a task you paid Government managed retirement charge on in lines 8a-d. Look for this information on Form W-2 from your employer.

- Your Social Security tax owed is determined on lines 9 through 10.

- Your Medicare tax responsibility is calculated based on line 11.

- Line 12 combines the totals from Line 10 and Line 11 to get the total amount for the freelance work.

- Multiply your self-employment tax by 50% on Line 13, then claim the resulting amount on a different Schedule 1 of Form 1040.

Part II - Optional methods to figure net earnings

- You can use this section to select one of the optional methods, which might entitle you to credit towards your social security retirement benefits even if your earnings from self-employment were minimal (less than $6,367) or a loss.

- It could also enhance certain tax credits such as the child and dependent care credit and earned income credit. Before choosing an optional method, make sure to consult with a tax professional.

How do Virtue CPAs help?

Recording assessments is important, but accounting is the journey that leads you there. Virtue CPAs expert team handles the accounting tasks for you. In addition to answering questions and completing tax preparation before filing, our team provides you with year-round tax services.

You get thorough consultation from qualified tax professionals at Virtue CPAs because of our expertise in handling federal and state taxes, ensuring you stay informed on the latest tax information, maximize deductions, take available tax credits, and reduce your tax bill.

Can I deduct my self-employment tax? If yes, then how much?

Yes, you can subtract half of the self-employment tax because the IRS sees it as a deductible expense related to your business. Enter the deductions on line 12a of Form 1040, whether you choose to itemize or take the standard deduction.

What happens if I manage multiple businesses?

If you earn money from different self-employment sources, just fill out one Schedule SE and add up all the gains or losses from each source.

What happens if I’m also an employee and get a stable salary?

There are two important things to remember when you have made self-employment income and have worked for someone else:

To avoid overpaying self-employment tax, use Long Schedule SE. When completing Long Schedule SE, remember to combine the amounts from Social Security wages (line 3) and Social Security tips (line 7) from W-2 form on line 8a of Long Schedule SE.

Bottom Line

Now, you can fill out the Schedule SE easily with convenience to schedule see instructions. Still, if you have confusion with instructions for schedule SE or have queries regarding schedule SE instructions 2024 or how to fill out the Schedule SE, then you can connect with us .

Virtue CPAs is one of the best accounting firms in Atlanta, USA . We are an experienced team of accountants and tax consultants who can manage all your tax procedures with ease, expertise, and compliance with IRS regulations.