State Tax Refunds

State Tax Returns are filed and now you will be looking for state tax refunds. Your refunds of the filed-up tax returns may vary in time, management, amount, and as well as the process of knowing refund status and getting paid in your account as per the state you live in or work in. Here, We have simplified the whole process of How You can check State Tax Refunds easily for any state you live in.

In this blog, we have explained in a step-by-step guide to check your state tax refunds.

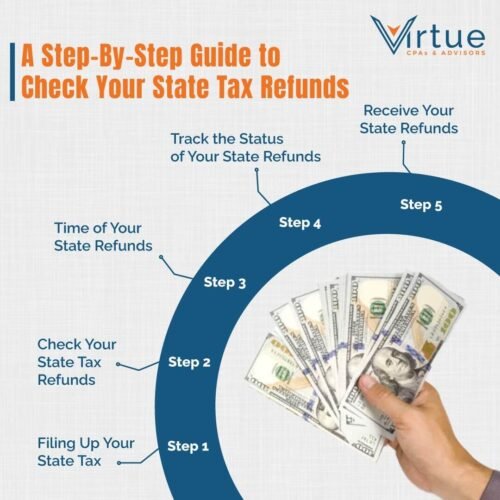

A Step-By-Step Guide to Check Your State Tax Refunds

Step 1: Filing Up Your State Tax

When you file your tax return for your state as per the state tax policy it will be different from your federal tax returns. In the application form for a State return, there will be a column that shows the exact amount of refund the state will pay you after filling up your tax return. Make sure that you note down or remember the amount of the refund.

However, you do not need to pay state tax if you live and work in the states of Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming where you are required to pay the federal tax only. To know more about your federal tax refunds, Read our blog: How to Check IRS Refunds in 2024.

Step 2: Check Your State Tax Refunds

You can check your state refund on the official website of the respective state by submitting the required details shown on the web page named usually, Where’s My Refund?

The Details You will need primarily for checking your state tax refund status:

1. Your Social Security Number

2. ZIP Code You live in

3. Exact Amount of Your Tax Refunds

4. Your Filing Status

Step 3: Time of Your State Refunds

After filling up your tax state return, usually, it takes 3 weeks to 12 weeks to pay your repayable tax refunds in your account differing from state to state. Also, it varies on whether you have filed an e-file tax return or a paper tax return in which refunds of paper tax returns take more time to be paid than e-file tax returns.

Step 4: Track the Status of Your State Refunds

In the time after filing your tax return, you can track your refund status on the website of the respective state’s revenue department and also you can connect with the department by calling on the official contact number on specified days and working hours.

Step 5: Receive Your State Refunds

States are highly prioritizing security measures to ensure the right citizens get the deserved state refunds. Therefore if the state finds any theft or fraud in your tax filing in the review process of your tax return then it can take more time to pay your tax refunds to safeguard from scams.

The revenue office of most states connects with the taxpayers on call and asks them the exact amount of tax refund to cross-check the state tax refunds. After checking and ensuring that the right person is going to get the state refund, the authority pays the state tax refunds to the taxpayers.

Conclusion

The process of getting tax refunds from state revenue departments is becoming easier day by day as the states created an ecosystem of web tools and applications for tracking your state tax refunds.

Still, if you have any queries, questions, or problems regarding your refunds of state tax return, you can Contact Us . We, Virtue CPAs & Advisors are a professional accounting and advisory firm in the United States. We provide comprehensive tax & advisory services with our experienced professional team of accountants and tax consultants.

Frequently Asked Questions (FAQs)

List of the State with its Contact Number for the Status of State Refunds:

Alabama: 334-309-2612

Arizona: (602) 255-3381

Arkansas: (800) 882-9275

California: 800-852-5711

Colorado: 303-238-7378

Connecticut: 860-297-5962

Delaware: (302) 577-8784

District of Columbia: +1 (202) 727-4829

Georgia: 877-423-6711

Hawaii: 808-587-4242

Idaho: 800-972-7660

Illinois: 217 782-3336

Indiana: 1-317-233-4018

Iowa: 515-281-3114

Kansas: 785-368-8222

Kentucky: (502) 564-4581

Louisiana: (888) 829-3071

Maine: (207) 626-8475

Maryland: (410) 260-7701

Massachusetts: (617) 887-6367

Michigen: 517-636-4486

Minnesota: 651-296-4444

Mississippi: (601) 923-7801

Missouri: 573-751-3505

Montana: (406) 444-6900

Nebraska: 800‑742‑7474

New Hampshire: (603) 230-5920

New Jersey: 1-800-323-4400

New Mexico: (866) 285-2996

New York: 518-457-5181

North Carolina: (877) 252-4052

North Dakota: 701-328-3127

Ohio: (800) 282-1784

Oklahoma: 405-521-3160

Oregon: 503-378-4988

Pennsylvania: 1-717-787-8201

Rhode Island: 401-574-8829

South Carolina: 1-844-898-8542

Utah: 801-297-2200

Vermont: (802) 828-2865

Virginia: 804-367-2486

West Virginia: 800-982-8297

Wisconsin: (608) 266-8100