Introduction

A lot of taxpayers miss the tax filing deadline on April 15. If you are one of them and haven't filed your federal taxes yet, then this blog is for you.

We have written this blog as a complete guide on tax extension, how to file a tax extension, how it works, and everything you need to know about tax extension in 2024.

Let’s know more!

What is Tax Extension?

A tax extension gives you extra time to submit your tax return to the IRS. Remember, a tax extension only gives you more time to file, not to pay. There is a difference between filing taxes and paying taxes.

The IRS states that a tax extension allows you more time to file your tax return. People believe that it also gives extra time to pay taxes, but that's not true. An IRS tax extension simply means you have a different deadline to finish your tax paperwork and estimate the tax amount you owe.

IRS advises that if you are ready to file your tax return, then do it as soon as possible.

When is the tax extension deadline in 2024?

If you have not paid the tax you owe on the Tax Day, i.e., April 15, then you can apply for a tax extension that gives you another 6 months to file your taxes. You can file your tax return till October 15. So, the tax extension deadline 2024 is October 15, 2024.

How to file a tax extension?

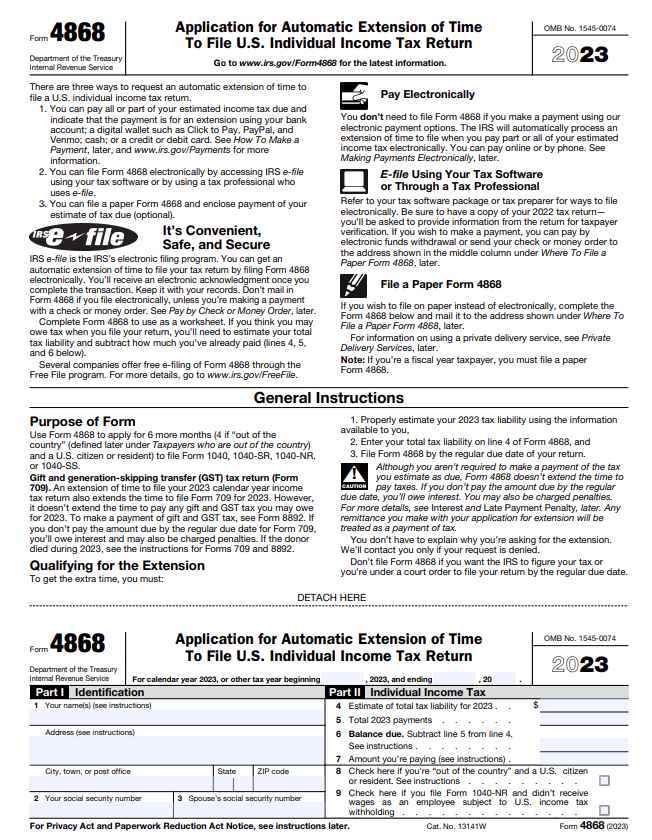

You need to fill out IRS form 4868 to file a tax extension.

You need to fill out IRS form 4868 to file a tax extension.

According to IRS form 4868, there are several ways to file an automatic tax extension deadline for filing your tax return.

1. IRS Direct Pay

You can request a tax extension when you Direct Pay the taxes you owe, because tax extension gives you more time to file, not more time to pay. So, when you pay your owed taxes directly from your checking or savings account, you can also file your tax extension form 4868 with it.

2. IRS Free File

Free File is a tax preparations service where you can file your taxes online. There are two different IRS Free File services, one is for certain income earning people and the other one is available for anybody and file your tax extension.

3. By Mail

You can request a tax extension by completing Form 4868 on paper and mailing it to the IRS using the Postal Service. Make sure to keep proof of mailing and remember that it needs to be postmarked by April 15.

4. Tax Software

You can also use tax software for filing your tax extension. You just need to add your tax related details in the software, attach relating forms and documents and submit your tax extension. And IRS will send you the electronic acknowledgement.

5. Tax Preparer

You can also get your tax extension form filed via CPA or your tax preparer who will file your tax extension on your behalf.

How does tax extension work?

You just fill out Form 4868 to get a tax extension. You don’t have to give a reason for the extension. You also don’t need to wait for the IRS to confirm or approve your request. The IRS will reach out to you only when they deny your request for tax extension.

Is there a penalty for filing a federal tax extension?

There is no penalty for filing a tax extension. But if you don't pay your taxes on time, it can be costly. The IRS will charge you interest each month on the unpaid tax balance until you pay the full tax amount.

As we have discussed, getting a tax extension gives time to file your tax return. So, you should pay your taxes whatever you can on April 15 and lower your tax amount.

If you don't pay at least 90% of your tax balance by Tax Day, the IRS will impose a late payment penalty. The penalty is 0.5% of the tax amount you owe each month, up to 25% of the total tax amount.

For instance, your total unpaid tax balance is $12000, and you have $10000 to pay for this month.

Therefore, the late payment penalty for month = $10000 × 0.5% = $50

So, total late payment penalty = $12,000 × 25% = $3000

Even if you have yet to file your return or file the tax extension form 4868, the IRS will charge the late filing penalty which is 5% of the tax amount you owe each month, up to 25% of the total tax amount.

Going with the same example, your total unpaid balance is $12000, and you have $10000 to pay for this month.

Then, the late filing penalty = $10000 × 5% = $500

So, total late payment penalty = $12,000 × 25% = $3000

That’s why you should file a tax extension without any delay so that you get time until October 15 to gather your tax documents and estimate your unpaid tax balance. Here are the ways to file a tax extension 2024.

Final Thought

Thus, you can file your tax extension by filling in form 4868. Make sure to add the correct details while filling out form 4868. Still, if you have queries regarding tax extension then contact us.

Virtue CPAs is a well-known accounting, taxation, and advisory firm in Atlanta USA. At Virtue CPAs, our tax professionals help individuals, small businesses, and large companies to file their taxes while staying compliant with the IRS regulations and meeting IRS tax deadlines.

Get in touch with us today!

FAQs

The IRS suggests that if you missed the tax filing deadline and requested an extension, you should estimate your tax owed and make a payment quickly. Otherwise, you will be charged interest and a late payment penalty on unpaid amounts after the deadline.

However, you can avoid the penalty by paying 90% of your taxes due before the deadline. You can use tax software or the Estimated Tax Worksheet on Form 1040-ES to figure out your estimated tax owed.

The IRS also suggests paying as much as you can to minimize extra fines if you can't pay your full tax amount.

Filing for a state tax extension depends on the state. There are some states that require their additional form for the state tax extension, and some allow a federal tax extension as a state tax extension and give the same deadline of mid-October.

You can contact your state’s tax department to know the state income tax deadline and how to request for a state tax extension.

FEMA declared some states as disaster affected areas in which the IRS allows taxpayers, businesses, and quarterly tax returns to pay in extended deadlines. Even if your necessary tax documents are in the disaster affected area, you are allowed to file a tax extension form.

You can find out which states are declared as disaster affected area by IRS on its IRS disaster relief page.

According to IRS Form 4868, follow these three steps to qualify for the tax extension:

1) Calculate your annual tax amount based on the information you have.

2) Write your total tax amount on line 4 of Form 4868.

3) Submit Form 4868 by the usual deadline for your return.